The Electronics Market- looking into the 60's |

|

If I had the time, it would be interesting to research how accurate this Electronic Market prediction from the January issue of Electronics magazine compares to how the decade actually ended. My guess based on most of the history of the electronics industry is that except for very fantastic prognostications of personal nuclear power sources and domestic robots in every household, the forecasts greatly underestimated actual progress. That is because discoveries are made so frequently and improvements made so quickly that after ten years there are innumerable new aspects of electronics that were never even dreamed of a decade earlier. According to one source, the consumer electronics market in 2020 was close to $700B, as compared to $1.6B in 1959. Adjusting for inflation, that $1.6B is the equivalent of about $14B in 2020, so the market growth for consumer electronics in that time period was around 50x ($700B/$14B). That is a significant increase in just one sector of the electronics industry. Assuming 40% of FY2020, $718B U.S. defense budget went to electronics (per MAE), that $287B ($32B in 1959 money) represents a $32B/$6.3B = 5x growth over the same time period (surprisingly small, really). So, what to make over this? Don't ask me; I don't know. Forecast is for increased sales in every major category with military sales leading the way. Industrial and commercial sales are rising fast.

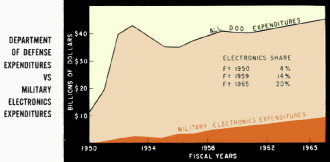

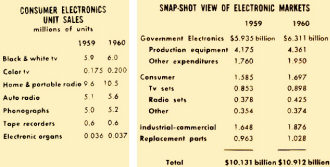

Thomas Emma, Howard K. Janis, Our Market The Manpower Picture The Electronics Market Market Research Tables Buying and Selling Abroad Getting Goods to Market Electronics Industry sales of end equipment and replacement parts at factory door prices should near $11 billion this year. By 1965, sales should rise above $16 billion. Last year's sales topped $10 billion for the first time. This mark was an 11-percent gain over 1958 sales. The bright sales outlook reflects recovery from the 1957-1958 recession and a pickup in military spending for electronics. Expanding business activity expected throughout the sixties, rising population totals, continued high military and government spending support these predictions. That's the summary of ELECTRONICS' latest yearend market forecast. Sales of all major segments of the industry are participating in the predicted sales growth. Electronics dollar export totals, equivalent to four percent of total industry sales, registered only a moderate sales gain in 1959 over 1958, although export sales of some specific industrial products fared better. Imports are up. Estimated electronics imports to U. S. of $120 million in 1959 were more than twice the 1958 figure. More than half the 1959 total came from Japan. Rising import totals could lead to a negative electronics foreign trade balance in the future. Growth of electronics markets is paralleled by growing manufacturers' interest in methods of distributing products. ELECTRONICS finds manufacturers are reexamining their distribution methods and asking such questions as: Are we using the most effective channels of distribution? How can we help to improve existing channels? An increasing number of manufacturers are working closely with electronics manufacturers' representatives and distributors. Military Electronics Moderately rising Department of Defense budgets over the next five years, coupled with increasing dependence of the armed services on electronic techniques and equipment, mean more electronics business for many years to come. Between 1950 and 1959 our share of DOD spending rose from four to 14 percent. By 1965 it will be 20 percent, as shown in the chart of DOD and military electronics expenditures. Military customers were the source of 58 percent of all electronics sales last year, taking $5.9 billion worth of electronic equipment and parts. In 1960 military sales are expected to reach $6.3 billion. Expected military sales of $9.8 billion in 1965 is almost equal to total industry sales today. Swing to manufacture of missiles in production quantities is an important reason for high military electronics spending in 1959 and 1960. Missile expenditures of $1.481 billion in 1959 are about thirty percent higher than 1958. Another substantial increase is looked for in 1960 which will boost the missile expenditure total to $1.7 billion.

Electronics communications expenditures, backbone of much military air defense system procurement, are becoming a substantial part of the defense business. By 1960, electronic communications expenditures will reach almost $1 billion and will represent 22 percent of military spending for electronics production procurement. Few areas of the electronics industry are growing faster than research, development, test and evaluation. In 1959-1960, sales will jump 36 percent. Estimate for 1960 is one billion dollars as against $733 million in 1958. The RDT&E budget category was initiated by the government last year. It combines the previous research and development category with expenditures for equipment in test and evaluation and not yet in quantity production. Missiles and space equipment are presently getting most of the RDT&E money. Missiles and astronautics got over $1.5 billion of $3.8 billion worth of total new obligational authority for fiscal 1960. Increasing amount and complexity of electronic equipment used by the armed services is boosting spending in the operation and maintenance budget category. The O&M category covers repair and overhaul of military equipment. The electronics part of that budget category is expected to be $890 million in 1959. Prediction for 1960 is $950 million. Over the next five years spending for space exploration and for air traffic control equipment will play increasing roles in the electronics business. Although not wholly for military purposes, these expenditures are included here because of the difficulty of separation. National Aeronautics & Space Administration and Federal Aviation Agency, in combination are expected to spend about $900 million in 1960 and about $2 billion in 1965. Electronics portion is currently estimated at one third and is rising. Figures do not include DOD spending for space, currently running at near $350 million. This sum is split between the RDT&E and missile electronics categories. Other military growth markets over the coming five-year period are infrared, point-to-point microwave communications equipment and antisubmarine warfare (ASW) equipment. By 1965 the infrared market is expected to grow from current $110-million level to $425 million. Over the same period a four-fold growth in point-to-point microwave expenditures from present $50-million figure is anticipated. Estimate of the ASW market have not jelled. Current spending is in excess of $132 million a year. In the past five years sales grew from almost insignificant levels. Consumer Electronics This oldest segment of the electronics business enjoyed a major rally in 1959. Last year's sales of $1.6 billion were 21 percent ahead of 1958, largely influenced by improving business conditions, higher automobile sales and depleted retailer and distributor inventories. The steel strike resulted in lower levels of entertainment set sales than anticipated in the last two months of 1959, particularly auto radio. But it had only a minor effect on total consumer electronics sales for the year. Moreover, steel strike sales losses should mean greater gains in 1960. Forecast for 1960 is for a continued high level of consumer business with a gain of about five percent, which will bring total consumer sales to almost $900 million. Bulk of gains in consumer product sales are accounted for by tv sets, radio sets and phonographs. Tv set sales of $853 million in 1959 were 19 percent ahead of 1958 and are scheduled for a five-percent increase in 1959. Radio set sales of $378 million last year were 23 percent ahead of 1959 and are headed for $425 million in 1960. Phonographs with $190 million in sales in 1959 were 20 percent ahead of the preceding year. Behind the improved black and white tv set business are increases in the number of second and third set homes; annual growth in number of homes wired for electricity and improved business conditions. Color sets continue as a minor part of tv set total sales. Estimates of sales growth vary from 10 to 25 percent annually. But actual sales figures are not available. Encouraging factor is that three manufacturers now actively pursuing the color set market report rapidly rising sales. By 1965 table portable tv sets and battery-powered transistorized models may dominate the black and white tv sales picture. Color tv could boom by then. Improvements in radio programs, which have led to greater consumer interest in radio listening and purchasing, plus big increase in portable sales are major factors behind radio set sales growth.

Rapid consumer acceptance of packaged hi-fi and stereo phonographs is a force behind phonograph sales growth. Electronic organs and other consumer electronics equipment such as garage door openers, toys, headlight dimmers and kitchen devices accounted only for $74 million of sales in 1959. But rising consumer incomes are expected to build demand for these items considerably in the coming five years. Estimated sales for this group of $93 million in 1960 is 25 percent ahead of 1959. Tabulation of unit sales of consumer equipment is shown in the table (next page, left). Industrial Electronics In the past industrial electronics has been a sleeping giant. Holding the potential for tremendous sales increases, the industrial category has thus far demonstrated greater potential for publicity than sales growth. However, rapidly rising research and development expenditures, need to modernize industrial plants, necessity of meeting foreign competition by lowering production costs - all point to wider use of electronics equipment by industry. Growing acceptance of electronics equipment by industrial customers is another major factor in the improving prospects for industrial electronics business. In many product areas such as data processing, testing and measuring and communications equipment, the job of winning acceptance has largely been won. Electronics industry manufacturers are now striving for acceptance of integrated industrial electronic systems. Progress in winning system acceptance is expected to be a major factor in development of industrial electronics sales through the sixties. ELECTRONICS estimates industrial and commercial electronics sales at $1.65 billion in 1959, a 14-percent increase over 1958. Another 14-percent sales increase in 1960 will bring the sales total to $1.9 billion. Estimated 1965 sales of $3 billion are based on a conservatively estimated 10-percent annual sales growth. Some observers are predicting a 12 to 14- percent growth rate during the period. Many manufacturers say that the electronics industry's greatest growth potential is in the field of industrial electronics business. Big factors in industrial sales are electronic data processing equipment (EDP), test and measuring equipment and industrial controls. EDP sales should reach almost a billion dollars by 1965. Sales forecasts for 1959 and 1960 are $350 million and $415 million respectively. Test and measuring instruments, closely related to spending on research and development are estimated at $275 million in 1959 and $310 million in 1960. By 1960 industrial controls should register at least $200 million, an average increase of 12 percent over the preceding two years. Other industrial products worth watching are air navigation, point-to-point microwave communications, land-mobile communications and nuclear electronics equipment. Replacement Parts Estimate for 1959 replacement parts sales is $963 million, a six-percent advance over 1958. In 1960 sales total should top $1 billion. Continuation of average growth rate will produce sales of replacement parts of $1.5 billion by 1965. A cloud in the replacement parts business picture is the trend to transistorization, which could eventually curtail consumer spending on replacement parts. Components Sales

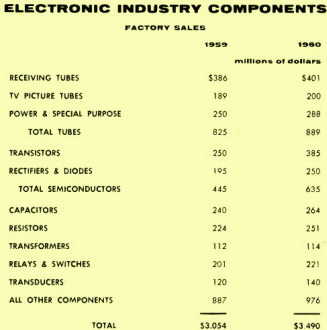

The components business experienced the benefits of increased military spending for electronics and generally healthy business conditions during 1959. Military demand for components with greater reliability plus ability to operate under extreme environmental conditions, which had a healthy influence on components sales last year, in continuing. Tubes are big business in electronic components. Total sales last year of $825 million were 13 percent ahead of 1988. Anticipated sales increases of 17 percent in 1959 and 15 percent in 1960 are expected to bring total power and special purpose tubes sales to $288 million in 1960. Military demand for microwave tubes is a big factor, with klystrons and travelling wave tubes doing particularly well. Predicted semiconductor sales in 1959 of $445 million are 89 percent ahead of 1958. Another 40-percent sales jump is anticipated in 1960. Transistor sales of $250 million in 1959 exceed 1958 by 121 percent. Sales gain for 1960 is conservatively estimated at 50 percent. Silicon transistor share of total transistor sales was estimated at $80 million for 1959. Silicon share is expected to increase to $130 million in 1960, one third of total forecasted transistor sales. Trend towards transistorization of electronic consumer and industrial equipment, plus increasing specification of transistor components in military equipment contracts, are behind transistor and semiconductor sales growth. Practically all other broad categories of electronic components are growing at a lively rate. Last year saw capacitors and resistors snap back from the sales declines they experienced in 1958. Dollar sales totals of both for 1959 are expected to be 20 percent or more ahead of 1958 and further sales advances are expected in 1960. Table (above, right) lists estimated 1959 and 1960 sales of major components.

Posted August 19, 2022 |

|