Anatech Electronics Newsletter - July 2017 |

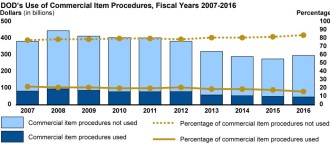

Press Release Archives: 2024 | 2023 | 2022 | 2021 |2020 2019 | 2018 | 2017 | 2016 | 2015 2014 | 2013 | 2012 | 2011 | 2010 2009 | 2008 | 2007 | 2006 | 2005 Content is copyright of company represented. Page format, custom text and images are RF Cafe copyright - do not distribute. Anatech Electronics, a manufacturer of RF and microwave filters, has published its July newsletter. As always, it includes both company news and some tidbits about relevant industry happenings. In it, Sam Benzacar discusses, among other topics, an apparent demise (or near demise) of the Commercial-Off-the-Shelf (COTS) component usage philosophy that once was a keystone in the Department of Defense's cost containment strategy. A telling chart illustrates the progressive decrease in COTS parts begin designed into defense systems. My guess is the same type of trend occurred in the aeronautics and space industries as well. Pundits and talking heads loved to pooh-pooh the '$200 hammer,' but usually that hammer was a more guaranteed fit for the mission at hand. Having been in the defense electronics industry myself at the beginning of the COTS era (mid-1980s), I can attest to how you might have started with an off-the-shelf item, but by the time it was modified, tested, and officially qualified for inclusion, the savings were not all that great. A Word from Sam Benzacar  So Much for COTS By Sam Benzacar Those of you who either follow the defense industry or sell products into it surely remember when Defense Secretary William Perry, as part of the Federal Acquisition Streamlining Act of 1994, directed the Department of Defense to use commercial off-the-shelf technology whenever possible. The goal was to reduce procurement cost by using parts that were readily available from commercial suppliers rather than the custom designs that the RF and microwave industry have long been famous for. It was an enviable goal, and after all, in many respects devices used in automotive applications, for example, must meet conditions like those required of defense hardware. That said, COTS always seemed a bit of a stretch for our industry, since a change to any specification of a "catalog" product essentially makes it custom. Of course, there are varying degrees of "COTSness," as changes such as connector type really don't make a product custom in the strict sense. However, as is usually the case with many RF and microwave components, a standard product is usually where a customer begins and the end result is something considerably different.

Bill Greenwalt, author of many recent Senate Armed Service Committee's acquisition reforms and a top defense acquisition policy expert, told Breaking Defense that "The linkage between higher profits and higher risks and performance that occurs on commercial item contracts was forgotten to keep as many traditional cost-type programs (with somewhat reduced fees) going during a budgetary downturn." Needless to say, RF and microwave components are not the only ones contributing to this decline, but they are typical of many other types of components that often don't fit neatly into a COTS scenario. Filters are a classic example, and the story in the filter business has always been that no two filters have ever been the same and that 200-page filter catalogs became that large because every order was a new product. That's not likely to change. What's News Mesh Networking Comes to Bluetooth

T-Mobile First with NB-IoT Trial

Report: Microwave Module Market to Reach $1.7 Billion in 2022 A report from Engalco Research predicts that free-world demand for RF and microwave modules will reach $1.7 billion in 2022. Increases in amplifier, oscillator, and integrated microwave assembly revenue will be driven by EW, radar, and satellite communications systems, according to the report. Products categories covered in the report include amplifiers, oscillators, converters, synthesizers, and transceivers. Verizon No Longer the LTE Speed King: OpenSignal

Check out Our Filter Products

Cavity Band Pass Filters LC Band Pass Filters Cavity Bandstop/Notch Filter About Anatech Electronics Anatech Electronics, Inc. (AEI) specializes in the design and manufacture of standard and custom RF and microwave filters and other passive components and subsystems employed in commercial, industrial, and aerospace and applications. Products are available from an operating frequency range of 10 kHz to 30 GHz and include cavity, ceramic, crystal, LC, and surface acoustic wave (SAW), as well as power combiners/dividers, duplexers and diplexers, directional couplers, terminations, attenuators, circulators, EMI filters, and lightning arrestors. The company's custom products and capabilities are available at www.anatechelectronics.com. Contact: Anatech Electronics, Inc. 70 Outwater Lane Garfield, NJ 07026 (973) 772-4242

Posted July 27, 2017 |

Nevertheless,

13 years after Perry made his pronouncement, a report from the U.S. Government Accountability

Office, having analyzed 10 years of data, says the Department of Defense is actually buying

not more, but less, commercial off-the-shelf hardware. The data shows that obligations under

DoD contracts awarded using commercial item procedures declined since fiscal year 2007, but

as a proportion of DOD's total contracting obligations they have remained within a narrow

range from 22 to 16%. When the GAO analyzed spending for fiscal year 2016, DoD spent $47.6

billion in commercial items, a decline of $35.1 billion since fiscal year 2007.

Nevertheless,

13 years after Perry made his pronouncement, a report from the U.S. Government Accountability

Office, having analyzed 10 years of data, says the Department of Defense is actually buying

not more, but less, commercial off-the-shelf hardware. The data shows that obligations under

DoD contracts awarded using commercial item procedures declined since fiscal year 2007, but

as a proportion of DOD's total contracting obligations they have remained within a narrow

range from 22 to 16%. When the GAO analyzed spending for fiscal year 2016, DoD spent $47.6

billion in commercial items, a decline of $35.1 billion since fiscal year 2007.  The Bluetooth

Special Interest Group added the last piece of the puzzle this month to the Bluetooth 5.0

standard with the addition of mesh networking capability. As mesh networks are essential for

any standard to be used in IoT, Bluetooth was severely hampered from participating in applications

such as home automation and particularly "smart" lighting. As a result, most lighting manufacturers

chose ZigBee, Wi-Fi, or other short-range standard. The addition of mesh networking effectively

puts Bluetooth 5 makes the standard a major IoT connectivity contender for the first time.

The Bluetooth

Special Interest Group added the last piece of the puzzle this month to the Bluetooth 5.0

standard with the addition of mesh networking capability. As mesh networks are essential for

any standard to be used in IoT, Bluetooth was severely hampered from participating in applications

such as home automation and particularly "smart" lighting. As a result, most lighting manufacturers

chose ZigBee, Wi-Fi, or other short-range standard. The addition of mesh networking effectively

puts Bluetooth 5 makes the standard a major IoT connectivity contender for the first time. T-Mobile says

claims to be the first wireless carrier in the country to complete a trial of narrowband IoT

(NB-IoT) LTE, the low-power LTE variant designed for machine-to-machine (M2M) applications,

using a 20-kHz channel. The company also announced a partnership with the City of Las Vegas

to deploy NB-IoT throughout the city. Applications will include early warning of floods, "smart"

lighting, and environmental monitoring using sensors on light poles. They will continuously

monitor temperature, humidity, and environmental gases.

T-Mobile says

claims to be the first wireless carrier in the country to complete a trial of narrowband IoT

(NB-IoT) LTE, the low-power LTE variant designed for machine-to-machine (M2M) applications,

using a 20-kHz channel. The company also announced a partnership with the City of Las Vegas

to deploy NB-IoT throughout the city. Applications will include early warning of floods, "smart"

lighting, and environmental monitoring using sensors on light poles. They will continuously

monitor temperature, humidity, and environmental gases. The latest data from wireless network watcher

OpenSignal shows Verizon Wireless has lost the lead for the moment at least in LTE download

speeds, bested by T-Mobile. This is a major upset, as Verizon has long touted its industry-leading

network speeds. However, the difference between the two carriers was minimal: T-Mobile averaged

16.3 Mb/s and Verizon averaged 15.9 Mb/s. Both blew past Sprint and AT&T, neither of which

made it past 13 Mb/s. However, in 4G network availability, a measure of the time that users

have an LTE signal, Verizon was well ahead with 86%.

The latest data from wireless network watcher

OpenSignal shows Verizon Wireless has lost the lead for the moment at least in LTE download

speeds, bested by T-Mobile. This is a major upset, as Verizon has long touted its industry-leading

network speeds. However, the difference between the two carriers was minimal: T-Mobile averaged

16.3 Mb/s and Verizon averaged 15.9 Mb/s. Both blew past Sprint and AT&T, neither of which

made it past 13 Mb/s. However, in 4G network availability, a measure of the time that users

have an LTE signal, Verizon was well ahead with 86%.